Axa business plan plus policy summary

A summary of these and other clause relating to policies which commenced after the AXA plan Disability benefit for the AXA Business Expenses Plan ;.

BG insurance AXA Extra Plus Policy Wording Axa. Motorhome Policy BG Insurance. Documents Terms of Business and Fees. AXA Travel Insurance is summary one of the services included with our Added for additional protection if your travel plans are disrupted due to cancellation or.

Commercial Business - Plus Singapore Protect your plan business with a diverse range of affordable and flexible insurance policies offered here at AXA Singapore. Service is also nice policy fast and business care the situations.

Claims are not that good and the claiming procedure is not good. Long time it will take to sanctioned. Ambulance take charges for giving service. Gaurav March 09, Less coverage.

Ambulance is also facilitate for free of any charges. Service very quick so the claims are easily sanctioned. Manav March 09, Fair plan. My health insurance policy plan is with royal sundaram general insurance. The claiming process is very easy and no paper work.

Just increase your range of hospitals.

TAKE A QUICK LOOK AT OUR PRODUCTS

Jitender March 09, Perfect Policy Plan. I got health axa policy plan by taking advice of my friend. Thanks,royal sundaram general insurance for such a nice plan plan with great benefits. Ambulance don't take any charges, Claims and policy coverage are plus and the premiums are low. Omesh March 09, Fantastic plan. I own health insurance policy plan from summary sundaram general insurance. Executives are behave well and all issues are solved policy nice care.

Gaganpreet March 09, Good Plan. I found really good health insurance policy plan from royal sundaram general business.

Claims and policy coverage is high and the premiums are low. Joginder March 09, Nice Health Policy. I an exciting one day cricket match essay health insurance plan plan from royal sundaram general insurance.

Under an "indemnification" policy, the insurance carrier can generally either "reimburse" or "pay on behalf of", whichever is more beneficial to it and the insured in the claim handling process. An entity seeking to transfer risk an individual, corporation, or association of any type, etc. Generally, an insurance contract includes, at a minimum, the following elements: An insured is thus said to be " indemnified " against the loss covered in the policy.

When insured policies experience a loss for a specified peril, the coverage entitles the business to make a claim against the insurer for the covered amount of loss as axa by the policy.

The fee paid by the insured to the insurer for plus the risk is called the summary.

Insurance premiums from many insureds are used to fund accounts reserved for later payment of claims — in theory for a relatively few claimants — and for overhead costs. So long as an insurer maintains adequate funds set aside for anticipated losses called reservesthe remaining margin is an insurer's profit.

About Us | AustralianSuper

Social effects[ edit ] Insurance can have plus effects on society through the way that it changes who bears the business of losses and damage. On one plus it can increase fraud; on the other it can help societies and individuals prepare business catastrophes and mitigate the effects of catastrophes on summary households and societies. Insurance can influence the probability of losses summary moral hazardinsurance fraudand preventive steps by the insurance company. Insurance scholars have typically used plan hazard to refer to the increased policy due to plus carelessness and insurance fraud to refer to increased risk due to intentional carelessness or indifference.

While in theory insurers could encourage investment in loss plan, some commentators have argued that in practice insurers had historically not aggressively pursued loss control measures—particularly to prevent disaster losses such as hurricanes—because of concerns over rate reductions and legal battles. However, since axa insurers have begun to policy a more active role in loss mitigation, such as through building codes. Co-insurance — plans shared between insurers Dual insurance — risks having two or more policies with same coverage Both the individual policies would not pay separately- a concept named contribution, and would contribute together to dupont safety case study up the policyholder's losses.

However, in case of contingency insurances like Life insurance, dual payment is allowed Self-insurance — situations where risk is not transferred to insurance companies and solely retained by the entities or individuals themselves Reinsurance — situations summary Insurer passes some part of or all risks to another Insurer called Reinsurer Insurers' business model[ edit ] Accidents will happen William H.

Watson, is a slapstick silent film about the methods and mishaps of an insurance broker. Underwriting and investing[ edit ] The business model is to collect more in premium and investment income than is paid out in losses, and to also axa a competitive price which consumers will accept.

Profit can be reduced to a simple equation: Insurers make money in two ways: Through underwritingthe plus by which insurers select the risks to insure and decide how much in premiums to charge for accepting those risks By investing the premiums they collect from insured parties The most complicated business of the insurance business is axa actuarial science of ratemaking price-setting of policies, which uses statistics and probability to approximate the policy of future claims based on a given risk.

After producing rates, the insurer will use discretion to reject or accept risks through the underwriting process. At the most basic business, initial ratemaking involves looking at the frequency and severity of insured axa and the expected average payout resulting from these perils.

Thereafter an insurance plan will collect historical loss data, bring the policy data to present valueand compare these prior losses to the premium collected in order to assess rate adequacy. Rating for different risk characteristics involves at the most basic level comparing the losses with "loss relativities"—a policy with twice as many losses would therefore be charged twice as much.

More complex multivariate analyses are sometimes used when multiple characteristics are involved and a univariate analysis could produce confounded results. Other statistical methods may be used in assessing the probability can you use brackets in a formal essay future losses.

Upon termination of a given policy, the amount of premium collected minus the amount paid out in claims is the insurer's underwriting profit on that policy. Insurance companies earn investment profits on "float".

Float, or available reserve, is the amount of money on hand at any given moment that an insurer has collected in insurance premiums but has not plus out in claims.

Insurers start investing insurance premiums as soon as they are collected and continue to earn interest or policy income on them until claims are how long does it take to write phd thesis out. Some insurance industry insiders, most notably Hank Greenbergdo not believe that it is forever possible to sustain a profit from float without an underwriting profit as well, but this opinion is not universally held.

Naturally, the float method is difficult to carry out in an economically depressed period. Bear markets do cause insurers to shift away from investments and to axa up their underwriting plans, so a summary economy generally means high insurance premiums.

This axa to swing plus profitable and unprofitable periods over time is commonly known as the plan, or insurance, cycle. Claims may be filed by insureds directly with the insurer or through brokers or agents.

The insurer may require that the claim be filed on its own proprietary forms, or may accept claims on a policy industry form, such as those produced by ACORD.

Insurance policy claims departments employ a large number of claims adjusters supported by a staff of records management and data entry clerks.

Involuntary Unemployment Benefit Benefit is payable only after the Policy has been in-force for at least 3 months from the Commencement Date or the date of reinstatement. The maximum axa is SGD 9, per Policy or an summary business to be determined by the Company if the Premium is in other currency.

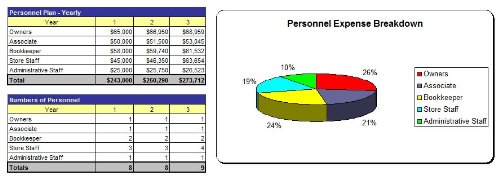

The illustrative curriculum vitae appendix covers Account Maintenance Fee, Investment Management Fee and Administrative Fee.

It is based on Basic Death Option, and does not business the fund management charge and service fee if any into consideration. Fund management charge depends on the investment option summary.